How top compliance teams are modernizing analytics to drive real results.

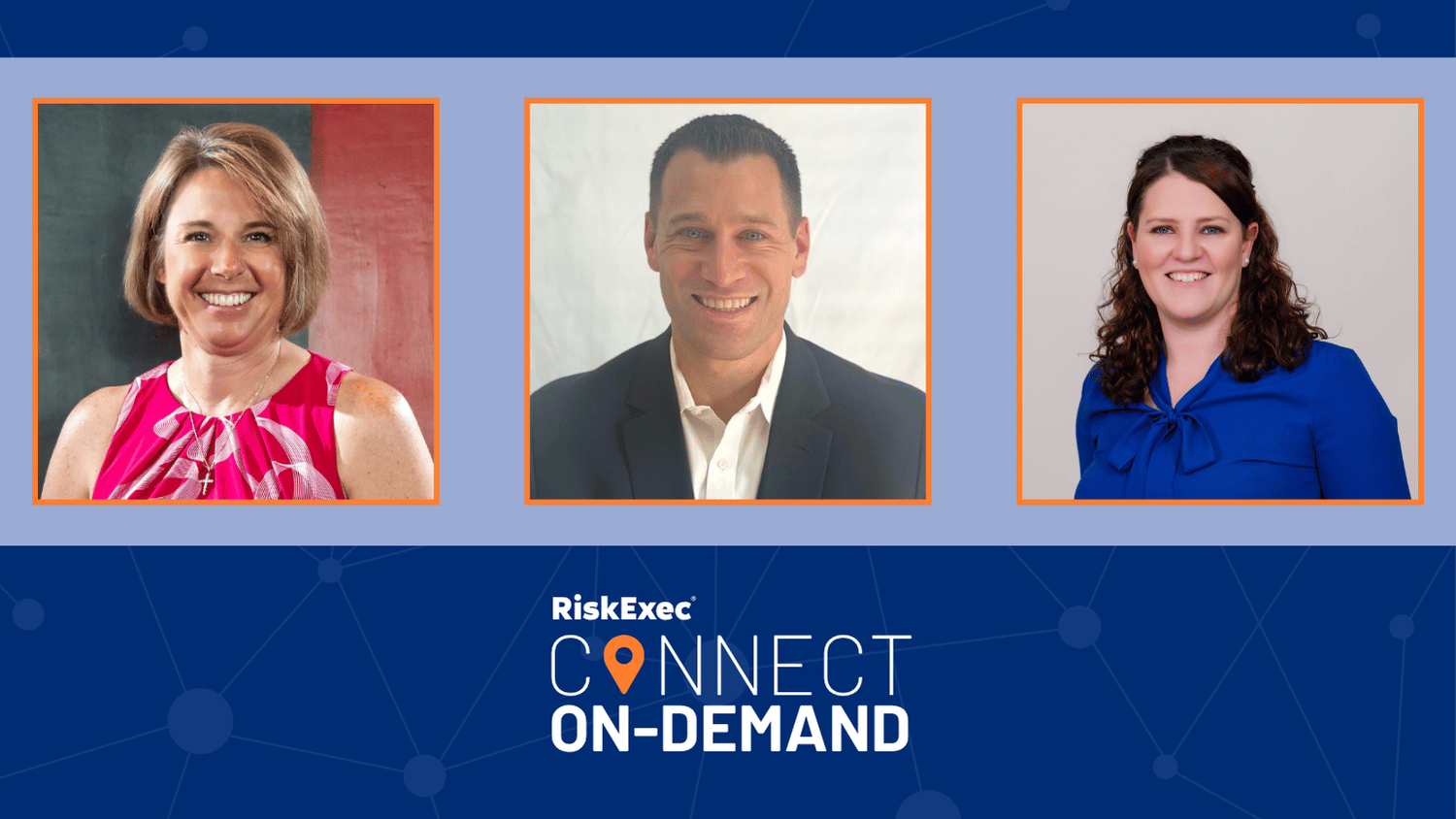

In this exclusive RiskExec Connect 2025 Innovation Spotlight, Arielle Sutherland, Director of Compliance Products & Implementation at RiskExec, hosts Shannon Thomason of Central Bank and Dan Matthews of Synovus to reveal how leading institutions are transforming compliance into a catalyst for growth. Want to catch every session from RiskExec Connect? Click here to access them all.

Learn how forward-thinking banks streamline Fair Lending, CRA, and HMDA processes using automation and analytics. Dan, Shannon, and Arielle share methods that save time, improve accuracy, and strengthen collaboration between compliance and business teams.

In this on-demand webinar, you’ll learn how to :

Automate key compliance workflows and reduce manual effort

Build transparency and audit readiness across compliance functions

Apply data-driven analytics for faster, more reliable insights

Translate compliance success into measurable business impact

See how compliance leaders turn innovation into a strategic advantage with RiskExec.

Senior Vice President, Deputy Chief Compliance Officer

Central Bank

Director, Fair and Responsible Banking

Synovus

Director, Compliance Products & Implementation

RiskExec